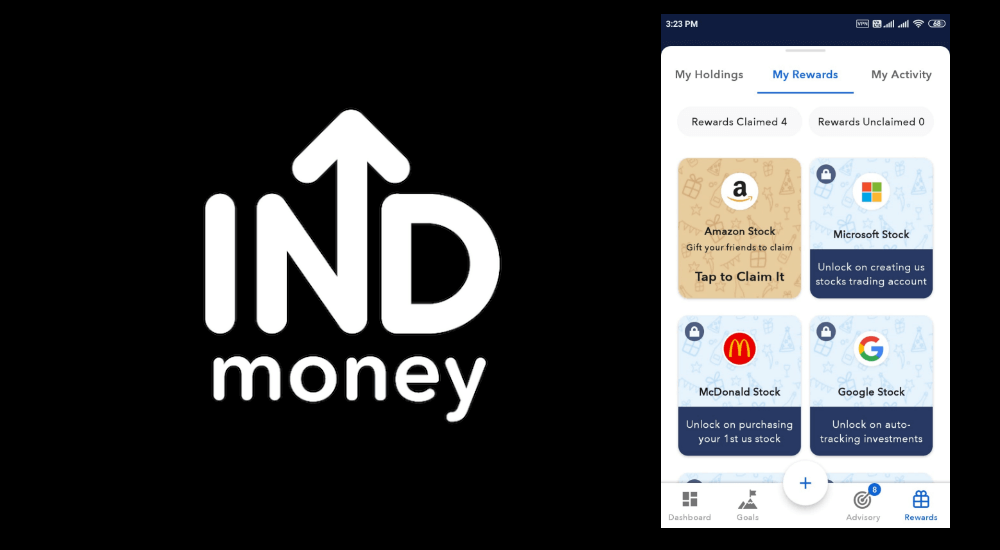

The INDmoney referral program is one of the greatest ways to get free US stock by referring your friends.

You will be rewarded for each referral you make just by encouraging your friends to download the app and finish the KYC procedure.

You will receive a scratch card for each person you refer, which you can later redeem for free Amazon stocks.

What is INDmoney

INDmoney is a Super Money App that manages all of your finances in one place. The app keeps track of all your existing investments at no cost.

INDmoney is a fantastic platform for investing in US equities from India at no fee and with a simple account opening method.

| INDmoney refer and earn program |

|

| Download INDmoney App |

Download Now |

| INDmoney Referral Code |

REH1QVNCUSS |

Update: To receive free stock, you must first deposit funds (worth Rs.1000) into your US stock account

How to Open INDmoney Account

- Download INDmoney App from Here

- Install the app & create your account by providing your details

- Complete KYC Process by Entering Your Aadhar Card & Pan Card Details

- Once Your Account is Active, Click on US stocks Tab from Top Menu

- Create US Stock Bank Account and Add Money to Activate Your Account

- Once Your account approved, You can start Buying any US stock

How to Refer Your Friends on INDmoney App

- Open INDmoney App

- Click on US stocks Section

- Check Earn Rs. 500 From Top

- Invite your friend and once they add Rs. 1000 or more to their US account, You will be rewarded with Scratch Card

- You can Earn Maxium 5 Referral Reward per month

How Does the INDmoney Referral Program Work?

The INDmoney referral program lets you to earn free US shares by referring friends. When your friends download the INDmoney app and open a new account, you will receive free US stocks.

You and your friend will each receive a scratch card that you can redeem from the rewards section for any quantity of stock ranging from Rs. 10 to Rs. 1000.

How many free US stocks will I receive as a reward of the INDmoney Referral Program?

This program allows you to invite an infinite number of friends to earn free US stock. The amount of the prize might be at random and changes on a regular basis.