When looking for the best credit card for yourself, the annual fee is an important component to consider. Almost everyone wants a credit card that gives them the most benefits for the least amount of money. Some people even hunt for credit cards that are interest-free for the rest of their lives since they don't want to pay anything for a credit card. Almost all card issuers provide lifetime free credit cards in response to such particular requests.

A lifetime free credit card has no annual or yearly fees. These free credit cards are best suited for beginners or first-time card users who have only recently began their professional adventure or have never used credit before.

Lifetime free cards are also appropriate for individuals who do not wish to pay an annual fee for the card. While the majority of credit cards in this category offer just basic advantages and often modest rewards rates, there are a handful that give exceptional value.

You may now understand what lifetime free credit cards are. A life time free credit card, as the name implies, is one that has no annual fees, i.e. there are no annual charges on these cards. Many people begin their credit journey with a free credit card since they appear to be the most cost-effective and risk-free to them.

To assist you in selecting the best card for you, we have compiled a list of some of the best lifetime free credit cards in India. You can assess several free credit cards online and then choose the one that appears to be the greatest fit for you and your needs.

List of Best Lifetime Free-No Annual Fee Credit Cards in India in

1. Axis Bank KWIK RuPay Credit Card

- Joining Fee: LTF

- Annual Fee: LTF

- Welcome Benefits: Rs. 250 Cashback on First UPI Transction on Kiwi App

- Best Suited For: UPI Payments. Get 2 EDGE RPs per Rs. 200 spent with the card on domestic and international spends. Further, you get up to 4 points on UPI transactions using Kiwi app which is equivalent to 1 rupee.

- Reward Type: Reward Points

- Milestone Rewards: N/A

- Lounge Access: N/A

2. Scapia Federal Bank Credit Card

- Joining Fee: LTF

- Annual Fee: LTF

- Welcome Benefits: N/A

- Best Suited For: 10% Scapia coins on every eligible online and offline spend. 20% Scapia coins on travel bookings done on the Scapia App. Zero forex markup on all international transactions.

- Reward Type: Reward Points

- Milestone Rewards: N/A

- Lounge Access: Unlimited domestic lounge access on a minimum spend of ₹5k.

3. Axis Bank MY Zone Credit Card

- Joining Fee: LTF or Rs. 500 + Applicable Taxes

- Annual Fee: LTF or Rs. 500 + Applicable Taxes (1st Year Rs 500. Waived on spending 5,000 within 45 days)

- Welcome Benefits: Complimentary SonyLiv Premium annual subscription worth Rs. 999

- Best Suited For: 4 EDGE Points for every Rs 200 spent with the card (reward rate of 0.4%). 40% discount on Swiggy up to Rs. 120 per order (minimum order value of Rs. 200 required). Buy One Get One offer on movie ticket bookings via Paytm movies.

- Reward Type: Reward Points

- Milestone Rewards: N/A

- Lounge Access: 1 per quarter

4. Amazon Pay ICICI Bank Credit Card

- Joining Fee: NIL

- Annual Fee: NIL

- Welcome Benefits: Weclome rewards worth Rs. 2200

- Best Suited For: 5% cashback on Amazon Shopping spends. 2% Cahback on Bill payments. 1% cashback on all other spends

- Reward Type: Cashback

- Milestone Rewards: N/A

- Lounge Access: N/A

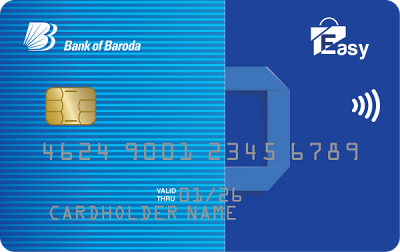

5. Bank of Baroda Easy Credit Card

- Joining Fee: LTF

- Annual Fee: LTF

- Welcome Benefits: N/A

- Best Suited For: 5 Reward Points for every Rs. 100 spent on Departmental stores, Movie spends. 1 reward point for every Rs. 100 spent on other categories. 0.5 reward point for every Rs. 100 spent on Select MCCs.

- Reward Type: Reward Points

- Milestone Rewards: N/A

- Lounge Access: N/A

6. ICICI Bank Platinum Chip Credit Card

- Joining Fee: NIL

- Annual Fee: NIL

- Welcome Benefits: N/A

- Best Suited For: 1 reward point per Rs. 100 spent on utilities and insurance. 2 reward points per Rs. 100 spent on retail purchases (except fuel).

- Reward Type: Reward Points

- Milestone Rewards: N/A

- Lounge Access: N/A

7. Kotak Bank League Platinum Credit Card

- Joining Fee: LTF

- Annual Fee: LTF

- Welcome Benefits: Get 5,000 Rewards points worth Rs.500/- on joining

- Best Suited For: Enjoy 8 Reward Points on spends done against every Rs.150/- spent.

- Reward Type: Reward Points

- Milestone Rewards: Spend Rs. 1,25,000 every 6 months and get 4 free PVR tickets or 10000 reward points

- Lounge Access: N/A

8. AU Bank LIT Credit Card

- Joining Fee: LTF

- Annual Fee: LTF

- Welcome Benefits: N/A

- Best Suited For: 1 Reward Point for every Rs. 100 spent on retail purchases with the card, 10X or 5X accelerated Reward Points (For Specific Feature), and Additional cashbacks (For Specific Feature).

- Reward Type: Reward Points

- Milestone Rewards: N/A

- Lounge Access: 4 complimentary lounge access per quarter

9. IDFC FIRST Millennia Credit Card

- Joining Fee: LTF

- Annual Fee: LTF

- Welcome Benefits: 5% cashback on initial EMI expenditure up to Rs. 1000 and extra Rs. 500 welcome gift vouchers on spending Rs. 15,000 within 90 days of card activation

- Best Suited For: 3 Reward Points for every Rs. 150 spent offline, 6 Reward Points for every Rs. 150 spent online, and 10 Reward Points for every Rs. 150 spent beyond Rs. 20,000

- Reward Type: Reward Points

- Milestone Rewards: N/A

- Lounge Access: N/A

10. HSBC Visa Platinum Credit Card

- Joining Fee: LTF

- Annual Fee: LTF

- Welcome Benefits: Amazon voucher worth Rs. 500, 3 free of charge lounge access/3 meal vouchers, 50% discount (up to Rs.100) on the first Google Pay purchase, and 10% cashback (up to Rs. 2,000).

- Best Suited For: Cardholders will receive 2 Reward Points for every Rs. 150 spend on this credit card. On Saturdays, BookMyShow offers a "Buy 1 Get 1" deal on movie tickets.

- Reward Type: Reward Points

- Milestone Rewards: N/A

- Lounge Access: N/A

11. IndusInd Legend Credit Card

- Joining Fee: LTF

- Annual Fee: LTF

- Welcome Benefits: Eexclusive welcome benefits, including gift vouchers from Oberoi hotels, Luxe, Montblanc, Post Card Hotels, and various shopping brands.

- Best Suited For: 1 Reward Point per Rs. 100 spends on weekdays and 2 Reward Points for every Rs. 100 you spend on weekends. Buy 1 get 1 free (BOGO) with up to 3 complimentary movie tickets every month.

- Reward Type: Reward Points

- Milestone Rewards: 4000 bonus Reward Points under the milestone benefits

- Lounge Access: 2 complimentary domestic lounge access every quarter

FAQs

Is a Lifetime Credit Card Indeed Free?

A lifetime free credit card is one that does not need you to pay an annual charge, renewal fee, or membership cost every year. To address your query, the lifetime free credit cards are truly free because there is no annual fees.

Who is eligible to apply for a lifetime free credit card?

If you are a first-time application looking for the best credit card for your specific needs. A no-annual-fee card is an excellent way to start your credit card journey. A credit card with no annual fee may be a good alternative if you have a poor credit score or a limited credit history. Because no annual fee credit cards are easier to obtain than other credit cards.

Can I use a lifetime free credit card internationally?

Yes, you can use your credit card abroad, although the fees will vary depending on the bank. As a result, verify with your lender about the fees that may apply if you use your card overseas.

Can I apply for a lifetime free credit card online?

Yes, most banks accept online applications for "lifetime free credit card."

Can i apply of lifetime free credit card without income proof?

Yes, individuals who do not have a job can apply for a credit card without providing proof of income. In this instance, you can apply for a secured card that is issued against a fixed deposit and has a credit limit that is somewhat lower than the fixed deposit amount. However, certain credit card companies may provide credit cards without requiring evidence of income and instead rely on your CIBIL Score.

Will I get lounge access with my lifetime free credit card?

Yes, You are eligible for free lounge access if your credit card provider provides it.

0 comments

Post a Comment